Contactless payment are just a tap away!

Make safe payments up to ₹5000 without a pin. Simply tap to pay with Visa and go contactless. It’s that easy!

Look

Tap

Go

Have questions about contactless payments?

All you need to know about contactless Visa cards.

What are contactless payments?

How do I make contactless payments?

Are contactless payments safe?

How secure is a contactless transaction?

Benefits of contactless payments

Tap to pay with Visa makes payments absolutely seamless for your shopping experiences. When you get convenience on every tap with the same advances security features keeping your card details safe, why pay any other way?

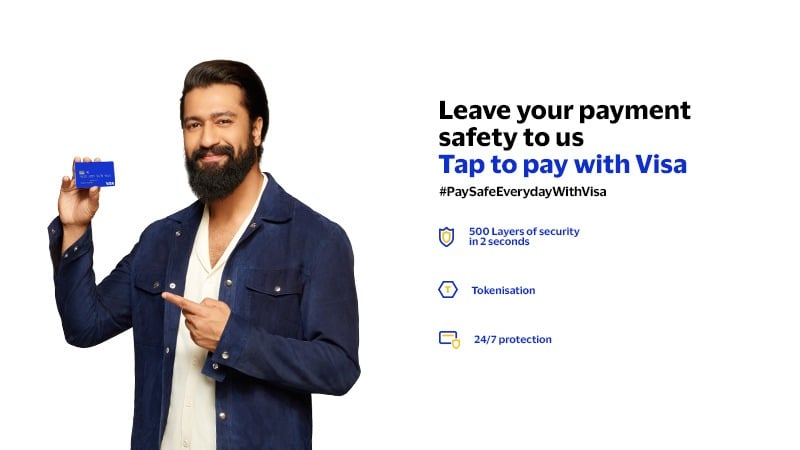

Tokenisation

Tokenising your Visa card for payments ensures the merchant only receives a unique token number instead of your actual card information. This added layer of security ensures that each payment made with Visa is safe and secure.

500* Security Layers

Payments with Visa protect your card as your information passes through 500 layers of security in just 2 seconds*, hence verifying all your transactions and keeping you safe from any fraud or threat.

Go contactless

Ask your bank for a contactless Visa card.

Q + A

Want to know more? Click to expand any of the questions below for additional information about the contactless Visa card.

-

There is no limit on the value of products a customer can purchase using the contactless Visa card. However, for a total bill value of ₹2000 or less, the customer can simply tap the card and complete the transaction (No PIN/signature is needed).

For a total bill value of ₹2000 or more, customers are required to enter their PIN/sign as per RBI guidelines.

-

You can tap to pay for transactions greater than ₹5000, but you would be asked to enter PIN to complete the transaction.

-

Charge slips can be chosen to be issued for all transactions below ₹2000. For transactions above ₹2000, a charge slip will be provided automatically.

-

No, the cashier will have to put in the amount in the terminal to activate the reader before the card can be tapped. Also, the card must be held within 4 cms of the contactless reader.

-

No, the terminals are designed to make only one transaction per card at a time.

-

No. Either one of the two cards may be read depending on which card is closer and has a better antennae. The cashier can check which card has been charged by reading the last 4 digits of the card. However, one must always encourage the customer to tap only one card at a time.

-

The cashier will have to void the incorrect contactless transaction and proceed to a new transaction.

-

No. If the card reader senses more than 1 contactless card, it will ask to select any 1. The number of contactless cards sensed by the card reader depends on multiple factors. Customers should always take their contactless Visa card out of their wallet to tap & pay.

-

Get in touch with your financial institution to see if contactless Visa card is an option for you.

-

You can use contactless Visa card at any merchant displaying the contactless symbol on the terminal readers.

-

Your financial institution should disclose any applicable fees during the application process.

-

Visa contactless transactions are just as secure as magnetic stripe transactions and are processed through the same reliable payment network. And, because you remain in control of your payment device during Visa contactless transactions, the risk of fraud is reduced.